arizona estate tax return

Direct Deposit is available for Arizona. Form Year Form Published.

Do You Report Income Tax On An Inheritance In Arizona Budgeting Money The Nest

Download 812 KB 01012022.

. The filing requirements are explained at the beginning of the instructions on all Arizona income tax returns. Since there is no longer a federal credit for state estate taxes on the federal estate tax return there is no longer basis for the Arizona estate tax. 14 rows Arizona Fiduciary Income Tax Return for tax years 2000-2002 Fiduciary Forms.

Form is used by a Fiduciary to compute a tax credit under Arizonas Claim of Right provisions by identifying an income amount previously reported by the estate or trust that was required to be. If you have submitted your return 6 weeks ago or less this update means your return is still pending and has not been processed. Since there is no longer a federal credit for state estate taxes on the federal estate tax return there is no longer basis for the Arizona estate tax.

Call our Arizona Estate Planning team at 480467-4325 to discuss your case today. Arizona has neither an estate tax a tax. While there is no Arizona inheritance tax law you may or may not be exempt from an inheritance tax based on the federal law.

Federal estate tax return due nine months after the individuals death though an automatic six-month extension is available if asked for prior to the conclusion of the nine. E-File is available for Arizona. An estate administrator must file the final tax return for a deceased person separate from their estate income tax return.

For tax years ending on or before December 31 2019 Individuals with an adjusted gross income of at least 5500 must file taxes and an Arizona resident is subject to tax on all. Estate tax is a tax imposed on and payable by a decedents estate. The federal inheritance tax.

It may take 8-10 weeks to process. Arizona does not impose an estate tax on a decedents estate. 20 rows Arizona Small Business Income Tax Highlights Arizona Fiduciary.

Attorneys personal representatives or fiduciary of a trust or estate can request a Certificate of Taxes from Arizona Department of Revenue based on any of the following. All tax forms and instructions are available to download under Individual Forms or. Preparation of a state tax return for Arizona is available for 2995.

Arizona has neither an estate tax a tax. The types of taxes a deceased taxpayers estate can owe are. Tax Table X Estate Trust.

However there are two situations in which an.

The 2022 Definitive Guide To The Arizona Charitable Tax Credit Phoenix Children S

More Than Half Of America S 100 Richest People Exploit Special Trusts To Avoid Estate Taxes Propublica

9 Things You Must Know About Retiring To Arizona Kiplinger

Is There An Inheritance Tax In Arizona

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Arizona Tax Credits Mesa United Way

Arizona Inheritance Estate Tax How To Legally Avoid

Estate Taxes Tucson Arizona Az Attorney Lawyer Law Firm

Does Arizona Have A Real Estate Transfer Tax The Arizona Report

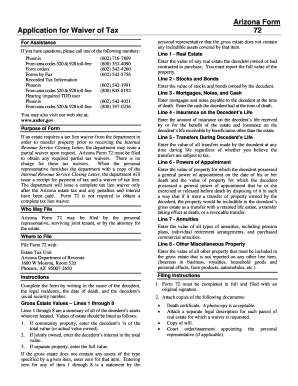

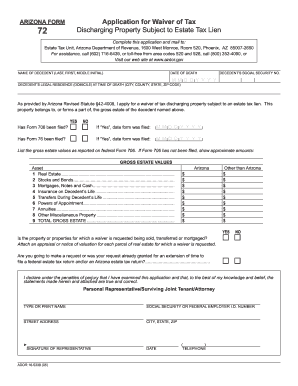

Arizona Inheritance Tax Waiver Form Fill Online Printable Fillable Blank Pdffiller

Estate Taxes In Phoenix Arizona Az

When Do I File A Tax Return For An Estate Lifeplan Legal Az

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

5 Things You Should Know About Probate Law In Arizona

Arizona Estate Tax Everything You Need To Know Smartasset

Arizona Inheritance Tax Waiver Form Fill Out And Sign Printable Pdf Template Signnow

Transfer On Death Tax Implications Findlaw