can i use my cash app card at atm

It allows cash withdrawals at ATMs that have the VISA Card acceptance marks. The Emerald Card can be used anywhere Debit Mastercard is accepted.

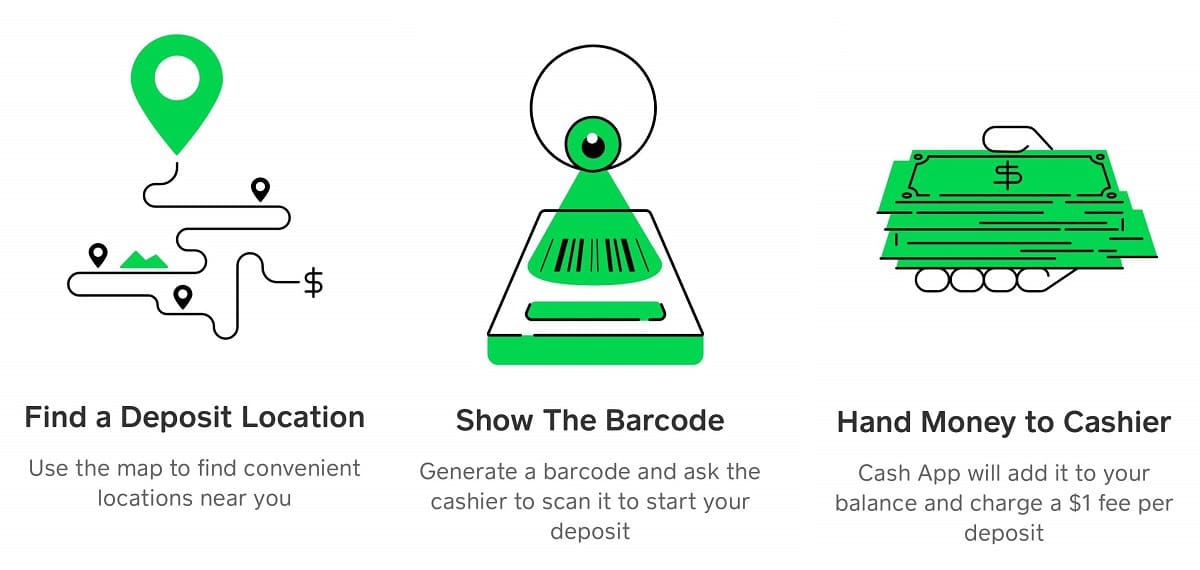

Cash App Atm Near Me Where Can I Load My Cash App Card For Free

Where can I use my emerald card at ATM.

. This method does carry a 2 fee with it although you really cant put a price on convenience. Find your nearest cash deposit location in the go2bank app or visit a retail location near you. Once you have successfully.

No you cant add funds to Cash App using an ATM. You can get the ATM fees reimbursed by setting up a direct deposit. To use your Cash Card at an ATM simply use your Cash Card and the PIN when you activate your card.

You can use Apple Pay at a store and sit Apple Cash as your default card. It does not provide services with international merchants. You currently cant use a prepaid card on Cash App to add funds to your account.

Enter the amount you wish to withdraw into the CashTapp app. How To Use Cash App Card At ATM Tutorial____New Project. You may spend 3000 total each day using your debit card.

Is There a Fixed Fee for Loading Money to my Cash App Card. Credit card cash withdrawals increase your credit card debt. Once you have received qualifying direct deposits totaling 300 or more Cash App will reimburse fees for 3 ATM withdrawals per 31 days and up to 7 in fees per withdrawal.

You can use your Cash App card to make cash withdrawals at the ATMs nationwide. Move your phone near the CashTapp sticker on the ATM until its securely connected. Then you have to enter amount.

Yes you can easily transfer money from Emerald Card to cash app card. 1000 per 7-day period. Cash Cards work at any ATM with just a 2 fee charged by Cash App.

First open cash app in you phone. You cannot take the money off of Apple cash through an ATM. This applies to any combination of other ATMs as well as merchants that offer cash back.

You can use the Cash App card called the Cash Card at retailers in the US that accept Visa and to withdraw money from your. Cash Cards work at any ATM with just a 2 fee charged by Cash App. Depending on the type of Card you have you may have Express Cash or Cash Advance.

To add money to your Cash App card at an ATM simply swipe your card in the machine enter how much you want to add and follow the prompts. The daily limit for Navy Federal ATMs is 1000 cash per day. To use your Cash Card to get cashback select debit at checkout and enter your PIN.

Here is a snapshot of a few pros and cons to help you decide if the withdrawal process is worth it to you. Some exceptions to the rule exist but most ATMs will not present a problem as long as your credit card permits it. You can withdraw Cash App funds from any ATM.

The transaction limit for Cash Cards is 7000 per transaction. Most ATMs accept credit card cash withdrawals. Can I use my emerald card for cash app.

Keep in mind that you cannot use a Cash App card outside the US. Will my stimulus check go on my emerald card. You can withdraw funds and check your balance though.

The Cash Card is a Visa debit card which can be used to pay for goods and services from your Cash App balance both online and in stores. Cash App Card ATM Pros and Cons. How much can you withdraw from Navy Federal ATM.

1000 per 24-hour period. Most ATMs will charge an additional fee for using a card that belongs to a different bank. The daily cash limit is 600.

Emerald Card customers can call 1-866-353-1266 and receive stimulus payment information by. However you can withdraw cash from an ATM using your Cash App Cash card and youll be charged a 2 fee per transaction for withdrawals. You can use your cash card to get cashback at checkout and withdraw cash from atms up to the following limits.

Express Cash requires enrollment and allows enrolled Card Members to. Once you have successfully activated free ATM withdrawals each qualifying deposit you receive after that will add an additional 31 days of ATM fee reimbursements. Can You Deposit Cash At ATM Into Cash App.

There isnt an ATM that doesnt charge a fee for Cash App. After that you have to link a prepaid card with your cash app. Your Cash Card can be used as soon as you order it by adding it to Apple Pay and Google Pay or by using the card details found in the Cash Card tab.

One of the cool features with cash app is that you can get a cash app debit card known simply as a cash card. You just need your Cash App debit card and Cash PIN at the time of the withdrawal. ATM surcharges and other fees that may be associated with your card can add up fast.

Is There a Way to Load Cash App Balance Using an ATM. Cash App SupportATM Withdrawal Limit. However you will be reimbursed by Cash App for up to 7 in ATM dispense fees once youve received qualifying direct deposits of 300 or more.

You can use your Cash Card to get cashback at checkout and withdraw cash from ATMs up to the following limits. Cash App accepts linked bank accounts and credit or debit cards backed by Visa American Express Discover or MasterCard. Select Capital One 360 Checking customers can withdraw money at any cardless ATM with a CashTapp sticker.

Yes you can add money to your cash app card at an atmYour cash card can be used as soon as you order it by adding it to apple pay and google pay or by using the card details found in the cash card tabYour cash card is directly linked to your available cash app balance so anytime you add money to your. How to withdraw money. There isnt a fixed fee for this - the stores are free to decide their fees.

Using Cash App card ATMs has many benefits but there are also some cons to consider as well. Use the ATM finder in the CashTapp app to find a cardless ATM near you. Our Express Cash and Cash Advance programs allow you the convenience of using your Card along with a designated PIN Personal Identification Number to withdraw cash at participating ATM locations worldwide.

Learn more about this on Cash Apps official website. Navy Federal ATM limits. Cash App instantly reimburses ATM fees including ATM operator fees for customers who get 300 or more in paychecks directly deposited into their Cash App each month.

You can use any ATM nationwide to withdraw cash from your Cash App account. Httpsbitly3zAvmn4-----Subscribe for More Reviews Herehttpswwwyou. Cash App instantly reimburses ATM fees including ATM operator fees for customers who get 300 or more in paychecks directly deposited into their Cash App each month.

Once you have successfully activated free ATM withdrawals each qualifying deposit you receive after that will.

How To Transfer Money From Chime To Cash App Instant Transfer

How To Use Cash App Card At Atm Tutorial Youtube

How To Reload Your Cash App Card In 2022 Stores Taking Deposits

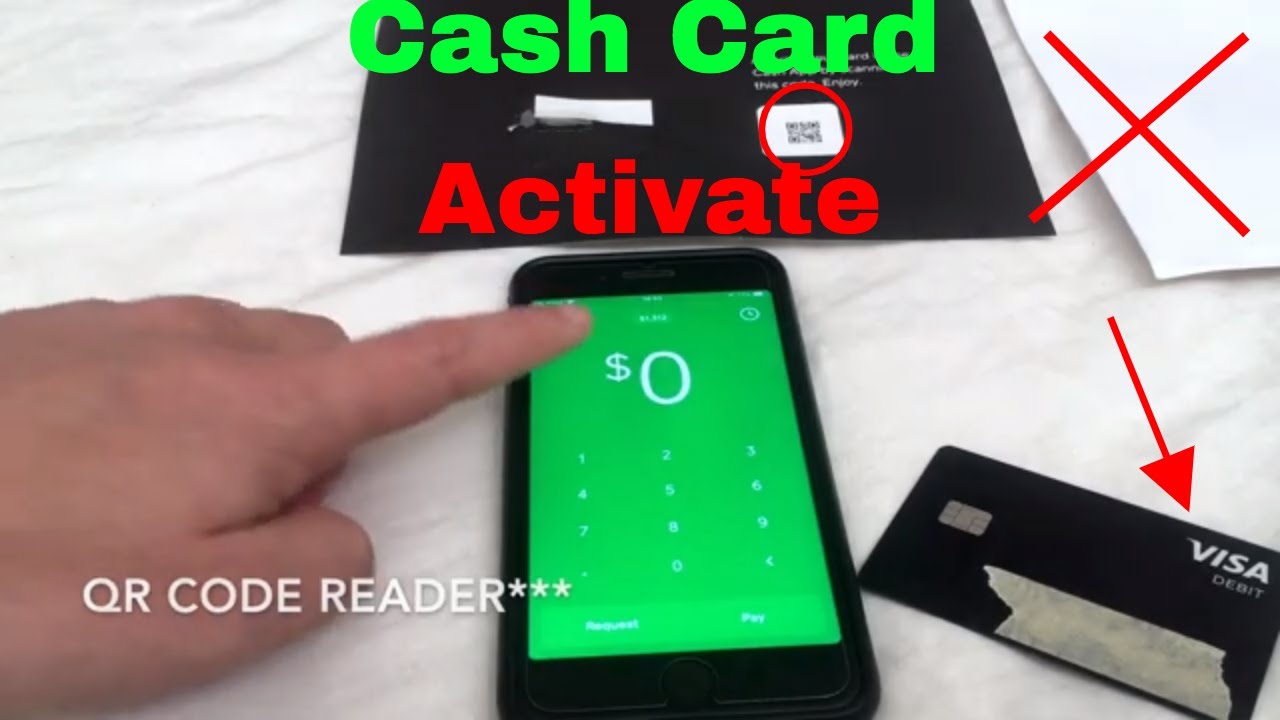

How To Activate Cash App Cash Card Youtube

How To Direct Deposit On Cash App Step By Step

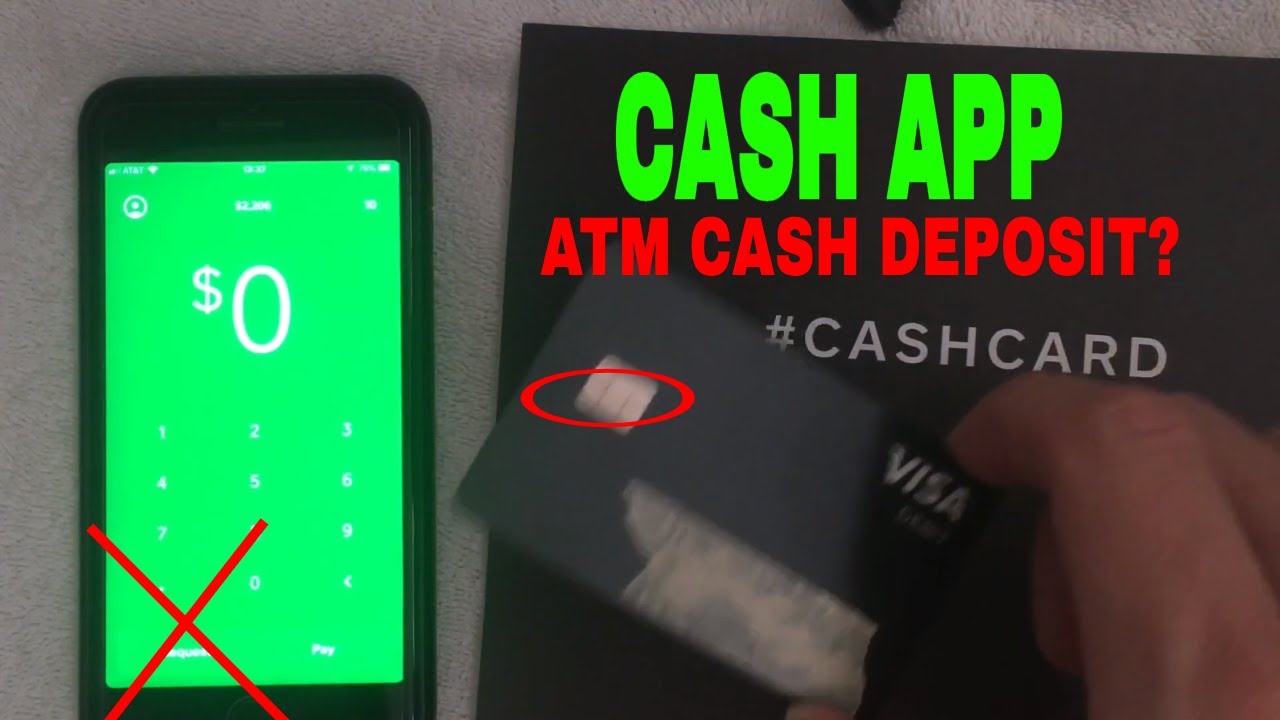

Can You Deposit Cash At Atm Into Cash App Youtube

Lincoln Savings Bank Cash App How To Use It

Where Can I Load My Cash App Card What Stores Retirepedia

How To Reload Your Cash App Card In 2022 Stores Taking Deposits

How To Add Money To Cash App Card Where Can I Reload My Cash App Card

Cash App Philippines 2022 How To Operate Cashapp In The Philippines

Square S Cash App Now Supports Direct Deposits For Your Paycheck Techcrunch

What Is The Cash App And How Do I Use It

How To Transfer Money From Your Cash App To Your Cash Card Visa Youtube

Cash App Vs Venmo How They Compare Gobankingrates